How to Set Up Shopify Payments in 4 Easy Steps

Top 10 Payment Gateways for Shopify

Shopify Payments

Shopify Payments is Shopify's own built-in payment processing solution. It's designed to streamline the payment experience for merchants and customers on your Shopify store.

Key features

- Integrated Solution: Built directly into Shopify, eliminating the need for third-party payment processors.

- Free Card Reader: Facilitates in-person payments with a complimentary card reader for physical transactions.

- Reduced Transaction Fees: Shopify's regular 2.2% transaction fee for payments processed through Shopify Payments is absent, reducing operational costs.

- Enhanced Security Features: Incorporates robust security measures to safeguard transactions and customer data.

Fees

- Transaction fees: Vary depending on your Shopify plan (typically 2.9% + 30 cents for online payments).

- Card processing fees: Also vary based on your Shopify plan.

Pros

- Convenient and cost-effective.

- User-friendly interface.

- Fast checkout.

- Lower processing fees compared to many third-party gateways.

Cons

- Limited availability in some countries.

- Potential for temporary fund holds by Shopify.

WorldPay

WorldPay

WorldPay is a leading Shopify payment gateway, offering diverse and secure transaction avenues for businesses of all sizes. With capabilities to process online, phone, and card payments, WorldPay extends convenience to Shopify users worldwide.

Key Features

- Multi-channel Payment Acceptance: Facilitates online, phone, and card payments, catering to various customer preferences.

- Broad Currency Support: Supports over 120 currencies, enabling global transactions without currency conversion concerns.

- Refund Without Charges: Allows merchants to process refunds without incurring additional fees, enhancing flexibility in customer transactions.

- Robust Fraud Protection: Incorporates advanced fraud protection features to safeguard merchants and customers against fraud.

Fees

- Standard plan: £19 GBP per month.

- Advanced Gateway Plan: £45 GBP per month.

Pros

- Wide international availability.

- Scalable for growing businesses.

- Strong security features.

- No fees for refunds.

Cons

- Pricing structure can be complex.

- Website information may lack clarity.

Authorize.net

Authorize.Net is a well-known payment gateway with a long history that offers reliable payment processing for Shopify stores. It supports various payment methods, including credit/debit cards, e-checks, and mobile payments.

Authorize.net

Key features

- Wide payment acceptance: Processes major credit cards, e-checks, and digital wallets like Apple Pay.

- Advanced fraud protection: Includes automated fraud detection and secure customer data storage.

- Flexible setup: This can be customized to fit your business needs.

- Excellent support: Provides helpful customer service.

Fees

- Setup fee: $49

- Transaction fee: 2.9% + $0.30 per transaction.

- Monthly gateway fee: $25

Pros

- Trusted and secure.

- Accepts diverse payment types.

- Strong customer support.

Cons

- It can be more expensive than some alternatives.

- Some users may find the setup process slightly complex.

Square

Square is a versatile payment solution known for its ability to handle online and in-person transactions. It is a good fit for businesses with a hybrid model. It offers useful tools for managing transactions and inventory.

Key features

- Online and offline payments: Accepts payments from your Shopify store and brick-and-mortar locations.

- Shopify integrations: Offers extensions to enhance your store's functionality.

- Inventory and transaction management: Provides a dashboard for tracking sales and stock.

- Security: PCI compliant and uses encryption to protect customer data.

Fees

- Standard transaction fee: 2.9% + $0.30 per transaction.

- Premium plans: Starting at $12/month for additional features.

Pros

- User-friendly for small to medium businesses.

- Simple pricing structure.

- Good for businesses with physical stores.

- Responsive customer support.

Cons

- It may not be ideal for very large-scale businesses.

- Occasional account stability issues were reported.

Paypal

PayPal is a globally recognized payment platform known for its ease of use and widespread customer adoption. It's a popular choice for Shopify merchants due to its convenience and familiarity.

Paypal

Key features

- Global reach: Accepts payments from a vast customer base worldwide.

- User-friendly: Offers a simple setup process and intuitive interface.

- Subscriptions and recurring payments: Easily manage recurring billing.

- Buyer protection: Provides peace of mind with purchase protection programs.

Fees

- Transaction fees: Typically 2.9% + $0.30, but can vary depending on plan and sales volume.

- Potential chargeback fees: May apply in case of customer disputes.

Pros

- High customer recognition and trust.

- Predictable, flat-rate pricing structure.

- Supports a wide range of currencies.

- Easy to use on mobile devices.

Cons

- Customer service can be inconsistent.

- Risk of account freezes or restrictions.

Opayo

Opayo (formerly SagePay) is a trusted payment gateway for merchants in the United Kingdom and the United States. It offers a flexible approach, accommodating both online and offline transactions.

Key features

- Versatile payments: Accepts online transactions, phone orders, and in-person card payments.

- Security focus: Prioritizes secure transactions and allows customers to pay via PayPal.

- Customer support: Provides reliable assistance when needed.

- Shopify integration: Easy to set up within your Shopify store.

Fees

- Monthly subscription: Starts at 19 GBP for up to 350 transactions, with varying tiers.

Pros

- Good customer support.

- User-friendly interface.

- Seamless Shopify integration.

- Affordable pricing structure.

Cons

- Lengthy account verification process.

- Strong security measures can sometimes slow down customer checkout.

Klarna

Klarna is a popular payment solution that focuses on "buy now, pay later" flexibility. It allows your customers to pay for installments, which can be especially appealing for higher-priced items.

- Buy Now, Pay Later: Provides customers with the option to pay for purchases in installments, which is particularly beneficial for high-value items, enhancing affordability and increasing sales potential.

- Seamless Integration: Facilitates easy integration with Shopify platforms, allowing merchants to implement Klarna's payment options without hassle.

- Immediate Payment: Ensures merchants receive complete payment at checkout, optimizing cash flow and reducing payment processing delays.

Fees

- Transaction fees: Typically 2.49% + 0.20 GBP per transaction within the UK and Ireland (fees may vary for other regions).

Pros

- Encourages customer spending with payment plans.

- Smooth integration with Shopify.

- Competitive transaction fees.

- The merchant receives full payment immediately.

Cons

- Customer support can be slow to respond.

Related Posts: 9 Best Shopify Payment Gateways in India

Amazon Pay

Amazon Pay leverages Amazon's familiarity to streamline the customers' checkout process. It allows shoppers to use their existing Amazon account information for payment, increasing convenience.

Amazon Pay

Key features

- Quick checkout: Customers can use the information they store on Amazon for fast payment.

- Global reach: Available to customers worldwide.

- Fraud protection: Includes Amazon's robust fraud prevention measures.

- Easy setup: Integrates smoothly with your Shopify store.

Fees

- Transaction fees: Typically 2.9% + $0.30 per transaction.

Pros:

- Extremely user-friendly for customers.

- Benefits from Amazon's strong fraud protection.

- Simple to integrate with Shopify.

- Eliminates the need for customers to re-enter payment details.

Cons

- Requires customers to have an Amazon account.

- Does not support PayPal transactions.

- Some risk of account restrictions due to Amazon's policies.

Verifone

Verifone (formerly 2Checkout) is a payment gateway offering flexibility and global reach. It allows merchants to select and pay for only the needed features, making it potentially cost-effective.

Key features

- Customization: Choose and pay for the specific features your business requires.

- Global transactions: Accepts payments from customers worldwide.

- Fraud protection: Includes risk management tools to help safeguard your store.

- Tax management: Provides features to assist with tax calculations.

Fees

- Transaction fees: Vary based on your chosen plan and sales volume (see Verifone's pricing for details).

Pros

- Flexible pricing structure.

- Accepts payments from around the world.

- Offers a variety of payment options for customers.

Cons

- May not be suitable for businesses selling high-risk products or services.

Stripe

Stripe is a widely used payment gateway known for its scalability and customization options. It's a good fit for businesses of various sizes, especially those anticipating growth.

Stripe

Key features

- Global reach: Accepts payments from customers worldwide in multiple currencies.

- Flexible for businesses: Supports invoices, subscriptions, and customizable checkout.

- Streamlined management: Offers sales tracking and easy operational oversight.

- Developer-friendly: Provides tools for advanced customization.

Fees

- Transaction fees: 2.9% + $0.30 per transaction.

- Optional instant payout: Additional 1% fee.

- International transactions: Additional 1% fee.

Pros

- Easy to set up with transparent pricing.

- No setup or cancellation fees.

- Supports a wide range of payment options and currencies.

- Highly customizable checkout experience.

- Excellent customer support.

Cons

- It can have a slight learning curve for some users.

- Limited availability in some countries.

How to Setup Shopify Payments for your Dropshipping business?

A successful dropshipping business needs a way to get paid! A smooth and secure payment system is critical to taking orders and generating income. Let's dive into how to do this on Shopify.

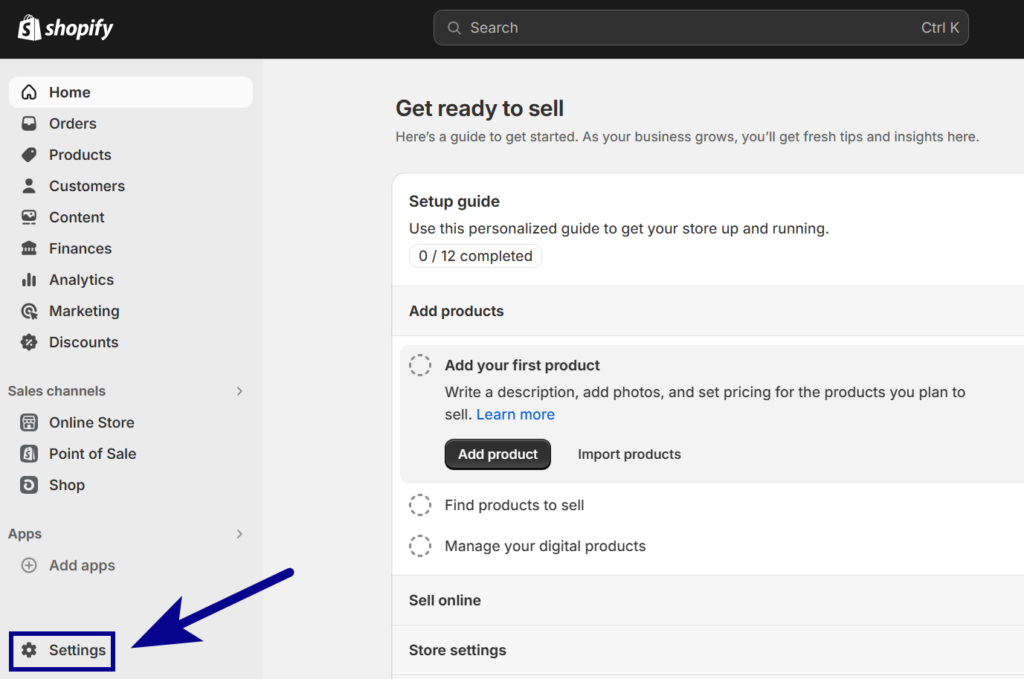

Step 1: Access Your Shopify Admin Panel

- Log in to the Shopify website and enter your store's login credentials (email and password).

- Admin Panel: Look for a main menu or navigation area once logged in. This usually has a section labeled "Settings" or an icon that resembles a gear. Click this to access your admin panel.

Access Your Shopify Admin Panel

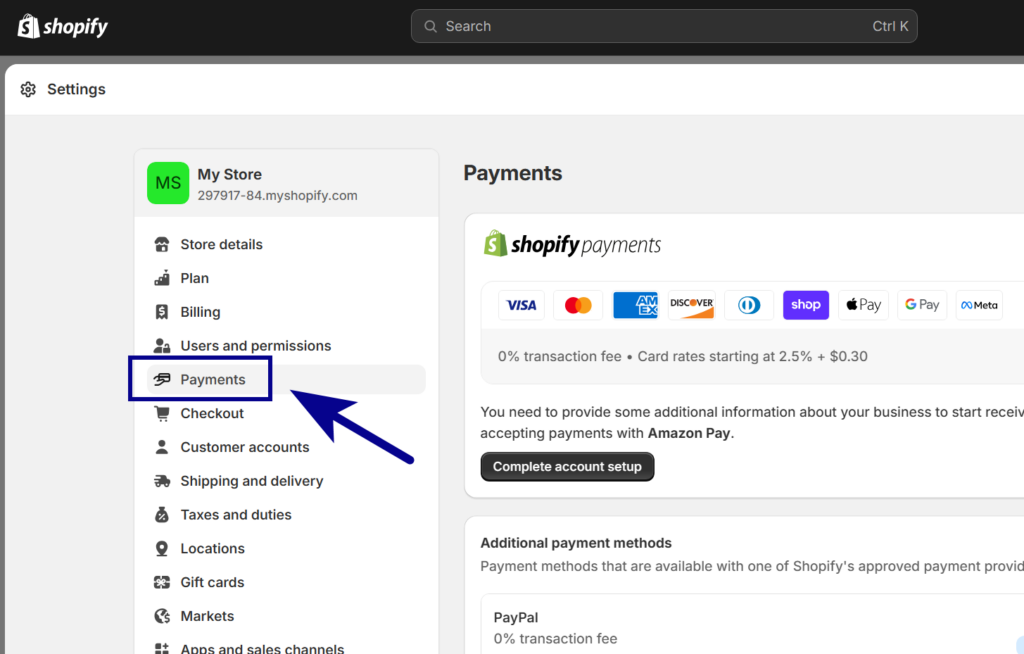

Step 2: Navigate to the 'Payments' Section

- Find Settings: Within your admin panel, locate the "Settings" tab. This is often found towards the bottom of a sidebar menu.

- Payments Section: Once in "Settings," look for a subsection specifically dedicated to "Payments."

Navigate to the 'Payments' Section

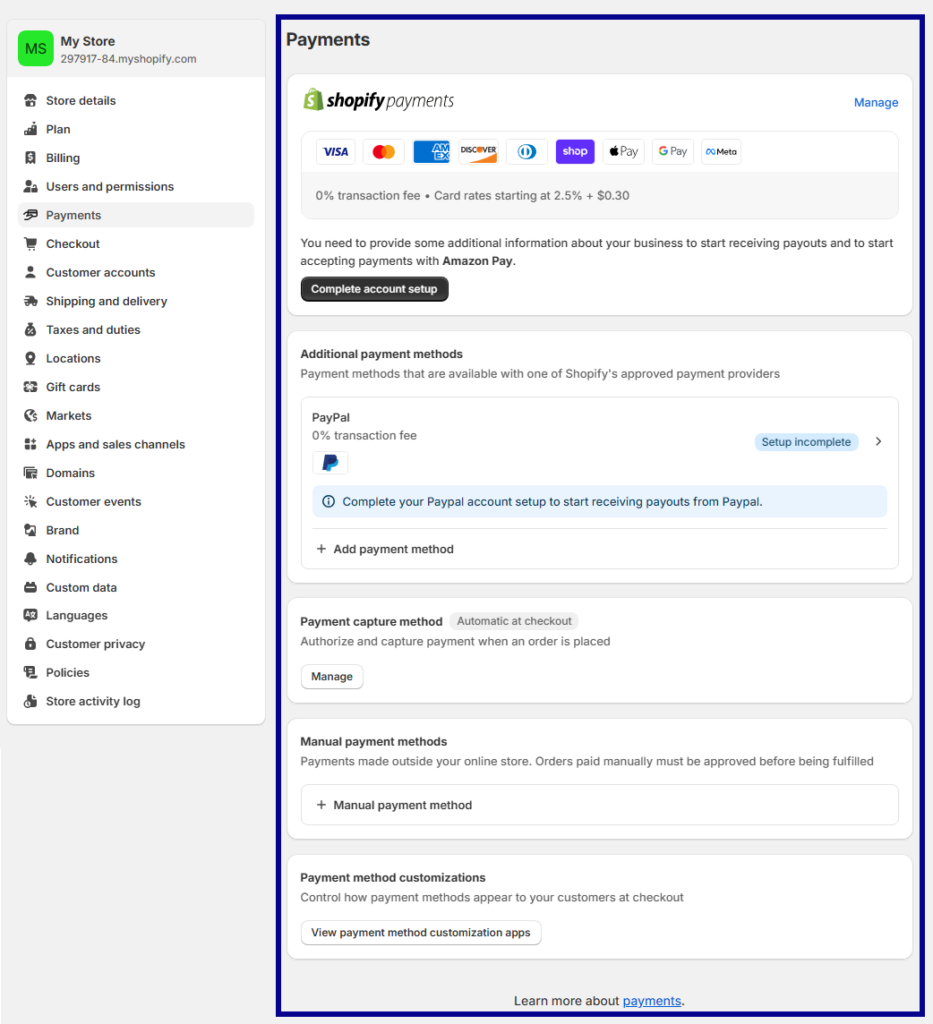

Step 3: Choose and Enable Your Payment Providers

- Shopify Payments: Check Availability: Ensure Shopify Payments is available in your location by checking their supported countries list.

- Deactivate Existing Gateways: Click the "Deactivate" button next to any currently active payment gateways. Then, confirm the deactivation.

- Activate Shopify Payments: Locate the "Shopify Payments" option under "Accept Payments." Click the "Activate Shopify Payments" button and follow the on-screen prompts.

- Third-Party Payment Gateways: Select Provider: Choose your desired gateway (PayPal, Stripe, etc.). Shopify likely has a list of supported providers.

- Follow Instructions: Each provider has specific steps for linking to your store. These usually involve creating an account with the provider and obtaining API keys to enter Shopify.

- Manual Methods: Locate Area: Find a section in your Payment settings for "Manual Payment Methods."

- Enable Options: Select the manual methods you want (e.g., cash on delivery, bank transfer) and follow the specific instructions.

Choose and Enable Your Payment Providers

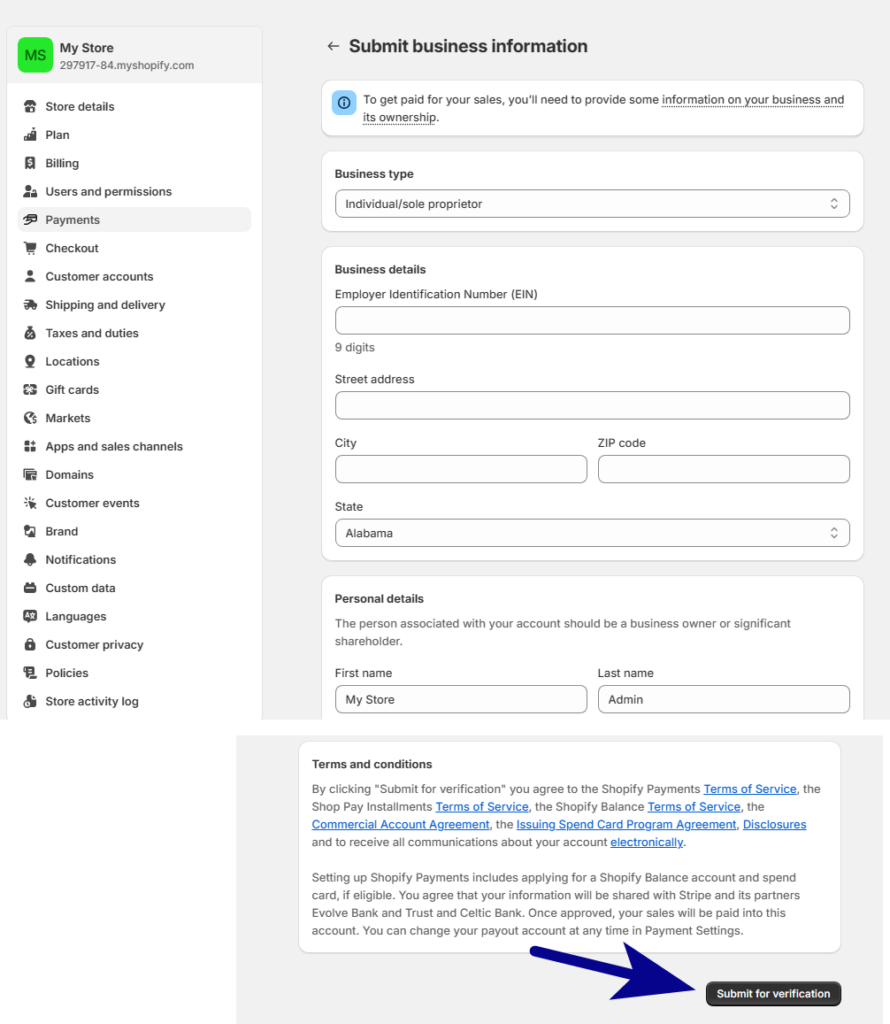

Step 4: Enter Business and Financial Details

- Business Information: Fill out fields including your legal business name, business type, address, and contact details.

- Tax Information: Provide your Taxpayer Identification Number (TIN). Depending on your country and business setup, this might be your Employer Identification Number (EIN) or Social Security Number (SSN).

- Bank Account: Enter your bank account number, routing number, and other details to receive payments.

Enter Business and Financial Details

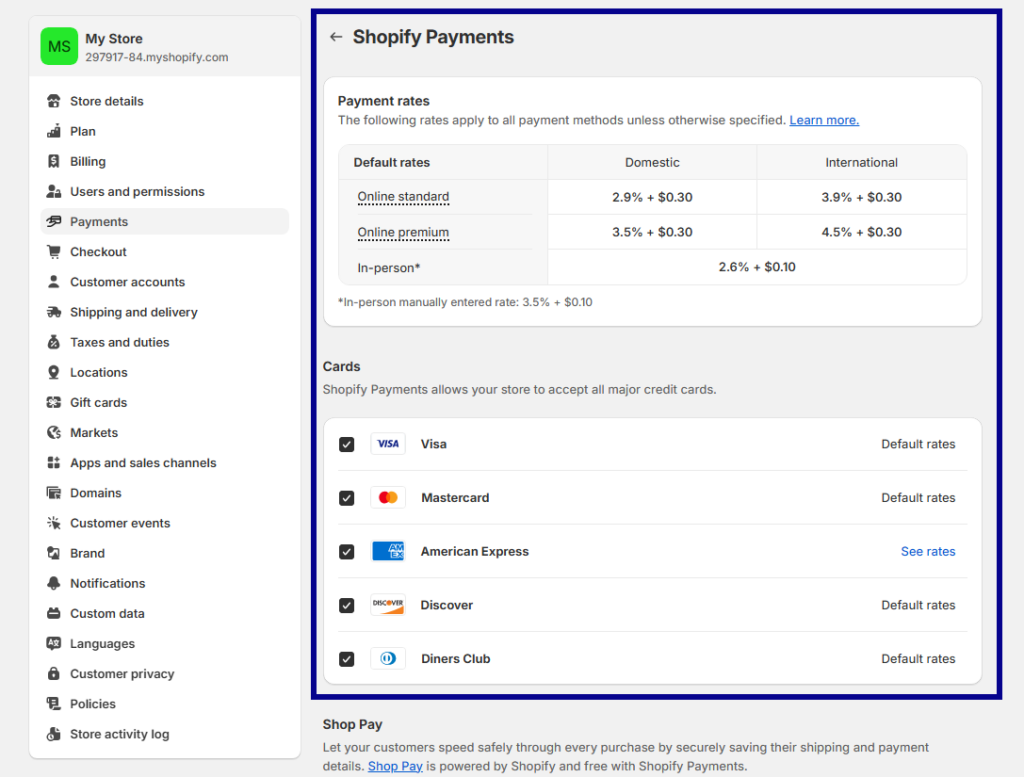

Step 5: Select Accepted Payment Methods

- Credit/Debit Cards: Choose which major card brands you'll accept (Visa, Mastercard, etc.). Tick the relevant boxes.

- Digital Wallets: Decide if you want to enable options like Apple Pay, Google Pay, or others supported by Shopify.

Select Accepted Payment Methods

Step 6: Customize Settings

- Taxes: Determine if you need to charge sales tax. Set up your tax rules and preferences within the Shopify Payments settings.

- Payment Authorization: Choose "Automatic" to have charges processed immediately upon order or "Manual" if you want to review each payment before processing.

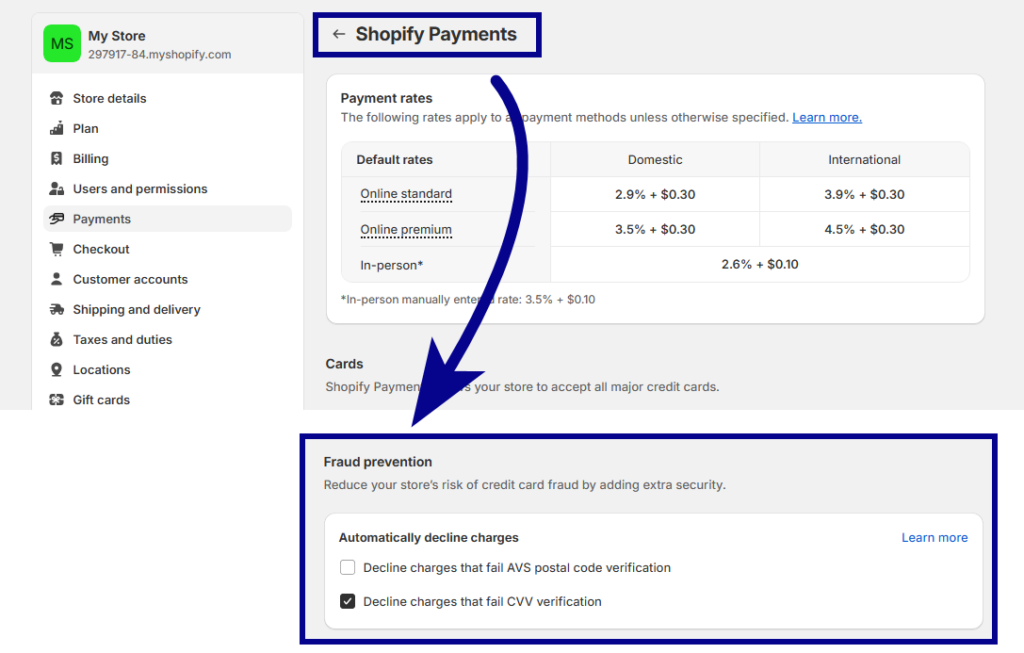

Step 7: Manage Fraud Prevention

- Fraud Settings: Access the "Fraud Prevention" section within your Shopify Payments settings.

- Customize Protection: Adjust filters and rules to set the level of fraud checks that match your business needs and risk tolerance.

Manage Fraud Prevention

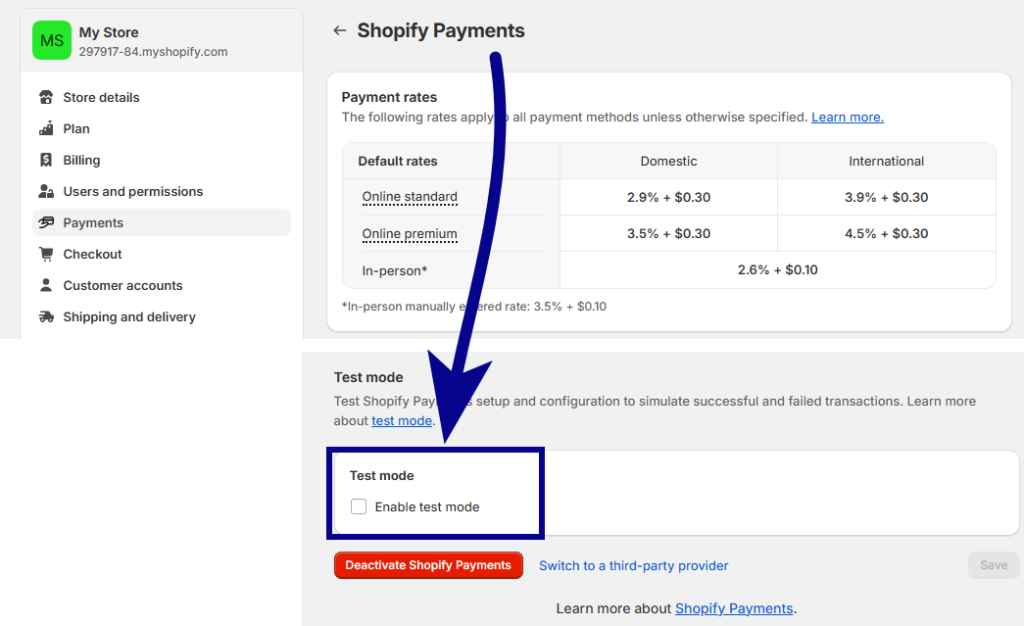

Step 8: Thoroughly Test Your Setup

- Test Mode: Enable "Test Mode" in your Shopify Payments settings. This lets you simulate transactions without real money changing hands.

- Bogus Gateway: Use Shopify's Bogus Gateway to mimic a customer's card information during checkout.

- Order Simulation: Go through the entire checkout process on your store as if you were a customer. Ensure the payment options work and the process flows smoothly.

Thoroughly Test Your Setup

Step 9: Go Live!

- Turn Off Test Mode: Once everything works to your satisfaction, disable "Test Mode" in your Shopify Payments settings.

- Start Accepting Payments: You're ready to receive real orders and payments!

Step 10: Monitor Transactions

- Admin Panel Monitoring: Regularly visit your Shopify admin panel to view transaction details and payouts and track your sales figures.

FAQ: Shopify Payment Setup

- Enable Digital Wallets: Offer options like Apple Pay and Google Pay for quick one-tap mobile payments.

- Simplify Forms: Minimize the number of fields customers must fill out at checkout.

- Security: Ensure Shopify Payments' security features are up-to-date to reassure mobile shoppers.

Related Posts: