How to set your tax rates in Shopify

The value-added tax or VAT is known as goods and services tax. As a merchant, it is necessary for the store owners to calculate this type of incrementally assessed tax and show it on their sales. Because it will be calculated and reported differently in different countries, they are so complex and changeable.

In some countries, it is required that the Shopify store owners show prices with included taxes. In some cases,the visitors want to update two but you want to see prices with and without VAT for their international customers or EU regions. Especially, all of the customers enable tracking their the final price.

It is automatic functionality for the Shopify store owners to update their tax rate, but the users might confuse whether they are correct or not. Therefore, this article How to set your tax rates in Shopify will be a tutorial will for any store owners to launch the tax rate in their shops.

How to set your tax rates in Shopify

For the Venture and Boundless themes, this tool does not support. For the products with only one variant, the prices will be updated through JavaScript or in a selectCallback function.

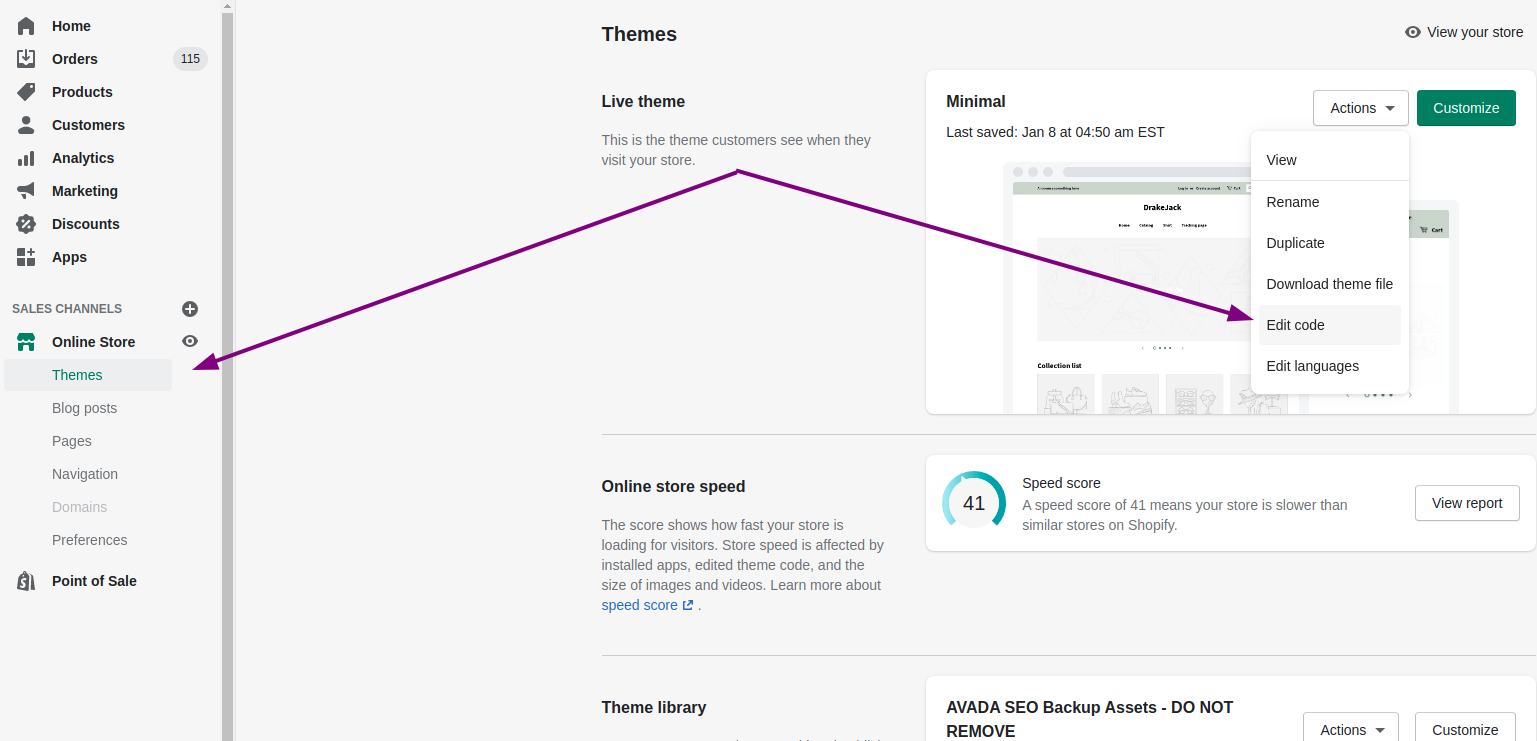

Step 1: Go to themes

The admins come to the Shopify admin, after that, they will click to Settings and then Taxes.

Step 2: Edit the code

At the Tax rates section, the store owners continue clicking on the name of their countries to adapt to that tax rate.

Step 3: Come to Assets directory

At this step, the store owners scroll down to Tax Settings to ensure that all taxes which are included in my product prices checkbox.

Step 4: Save changes

Press Save to save any change.

Conclusion

Through this article How to set your tax rates in Shopify, we hope that the Shopify store owners can have the overview and simple process about tax rate in Shopify. Other guiding articles that the online merchants can refer more about configuring themes in Shopify such as How to modify your theme on the product page and How to modify your theme on the cart page.