How to Set Up Tax Rates in Countries Other Than The United States on Shopify

After visiting the previous post, you must have known about how to set up automatic tax rates in the United States. However, it is only used for the store which based there. This doesn’t mean the others can’t set up tax rates because of the different location. Hence, I’ll take you through how to set up tax rates in countries other than the United States with the following step-by-step guide.

Related Posts:

- Set Tax Rate for New POS Location on Shopify - A How-to Guide

- How to Set Up Automatic Tax Rates on Shopify

- How to Set Up Tax Rates Manually on Shopify

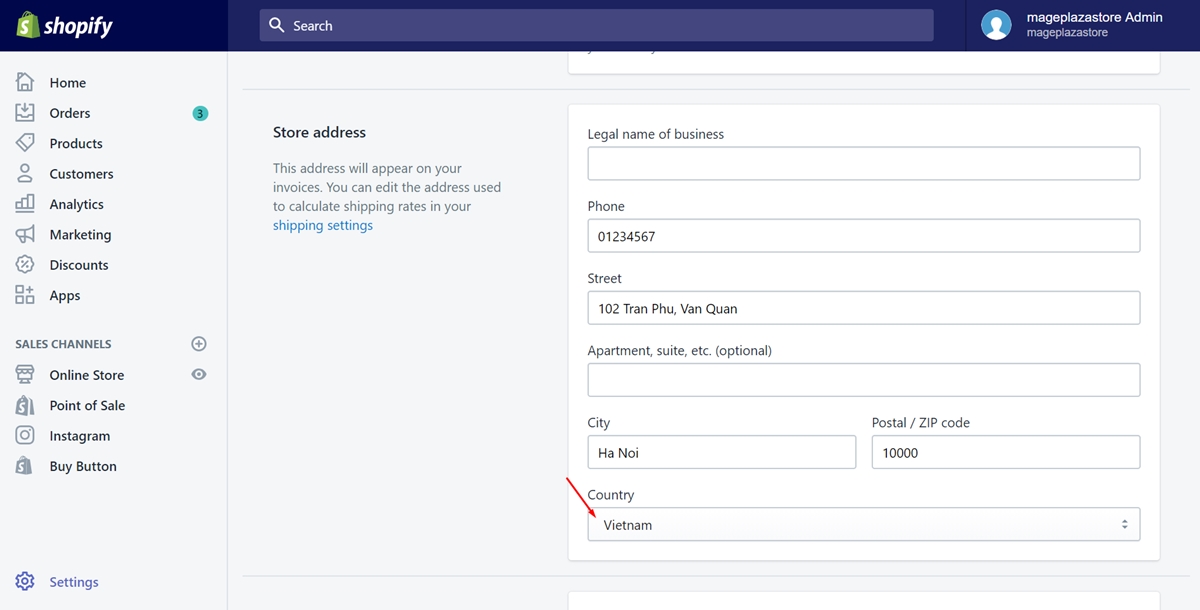

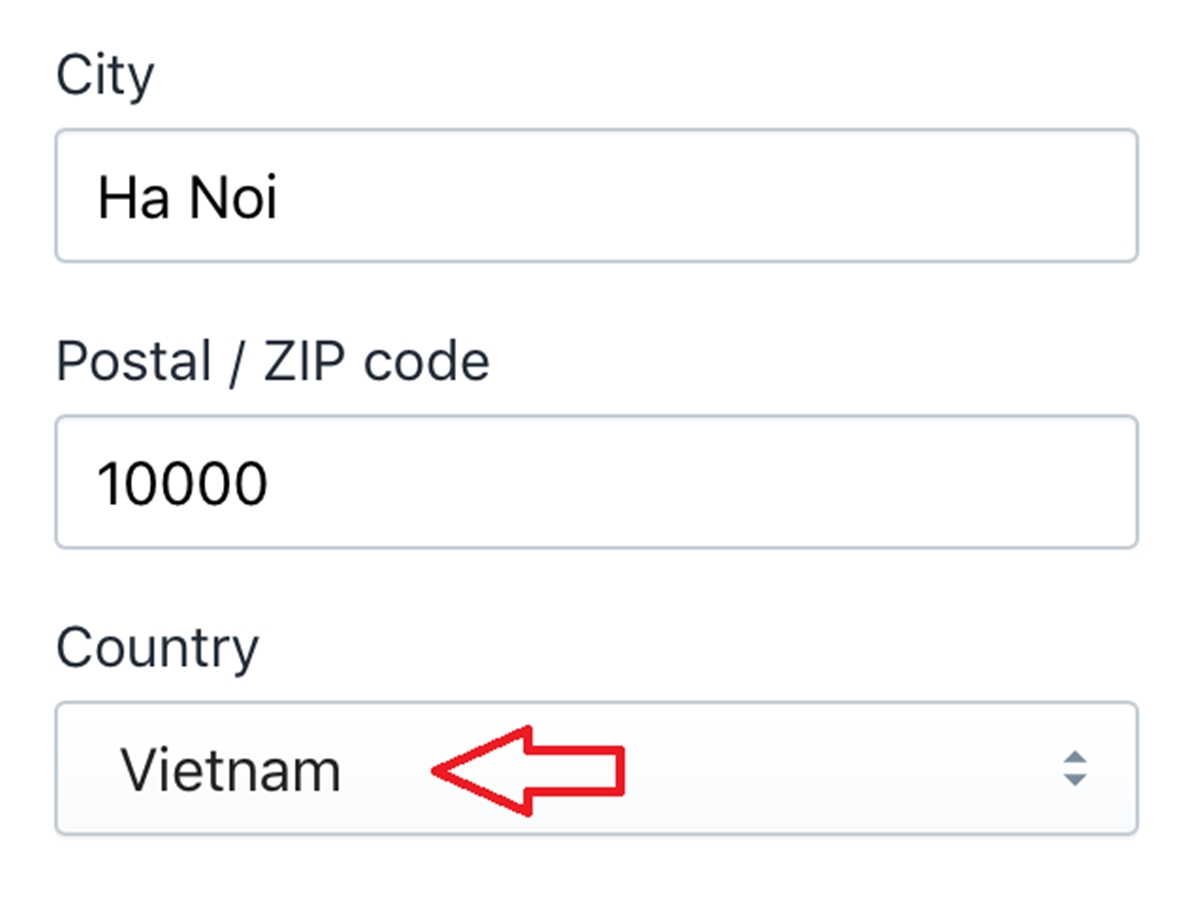

Step 1: Make sure your store based outside the United States

First of all, you need to log in your Shopify account to access the admin page. Go to the Settings section on the left-hand side of the page. Then, choose General. Scroll down to find which place your store is in. If it isn’t the United States, continue to the next step.

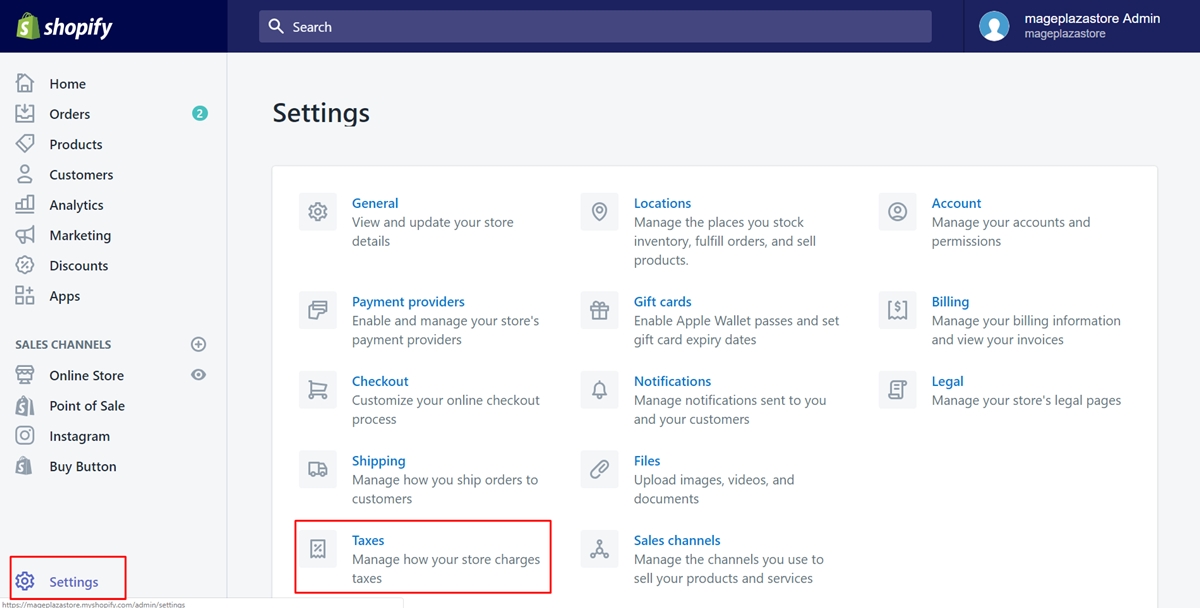

Step 2: Go to Settings and Taxes

Back to the admin page and choose the Settings button again. After that, press on Taxes to do every affair involved in tax.

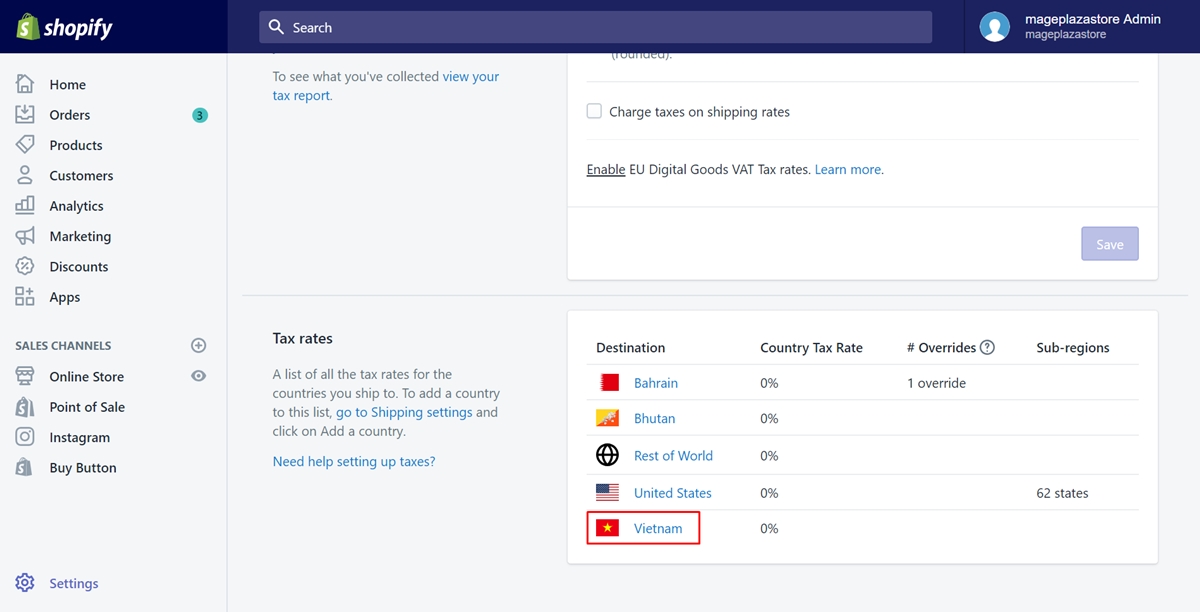

Step 3: Choose the country {#step-3

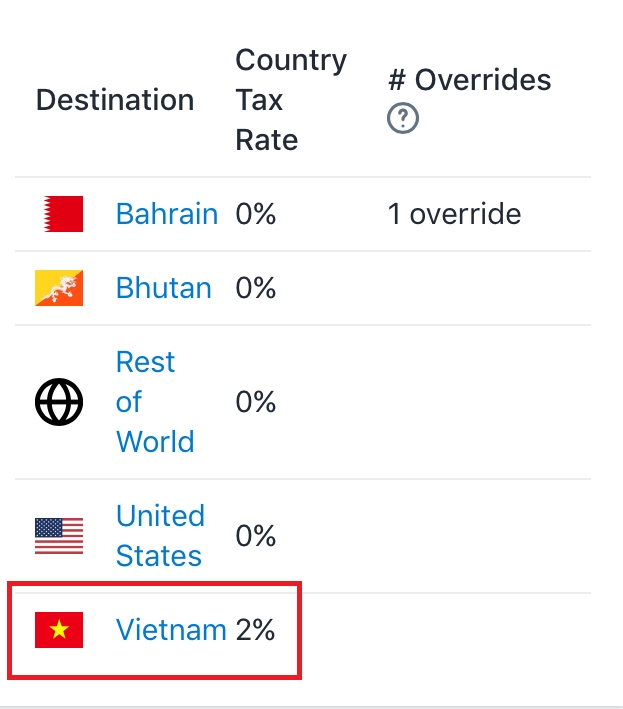

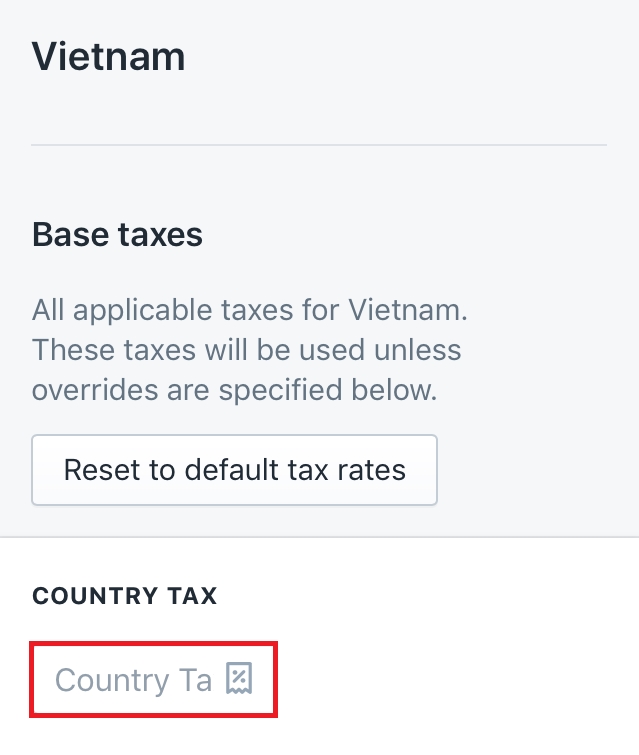

Look for the Tax rates field. In the destination list, find the country’s name of your store address and tap on it.

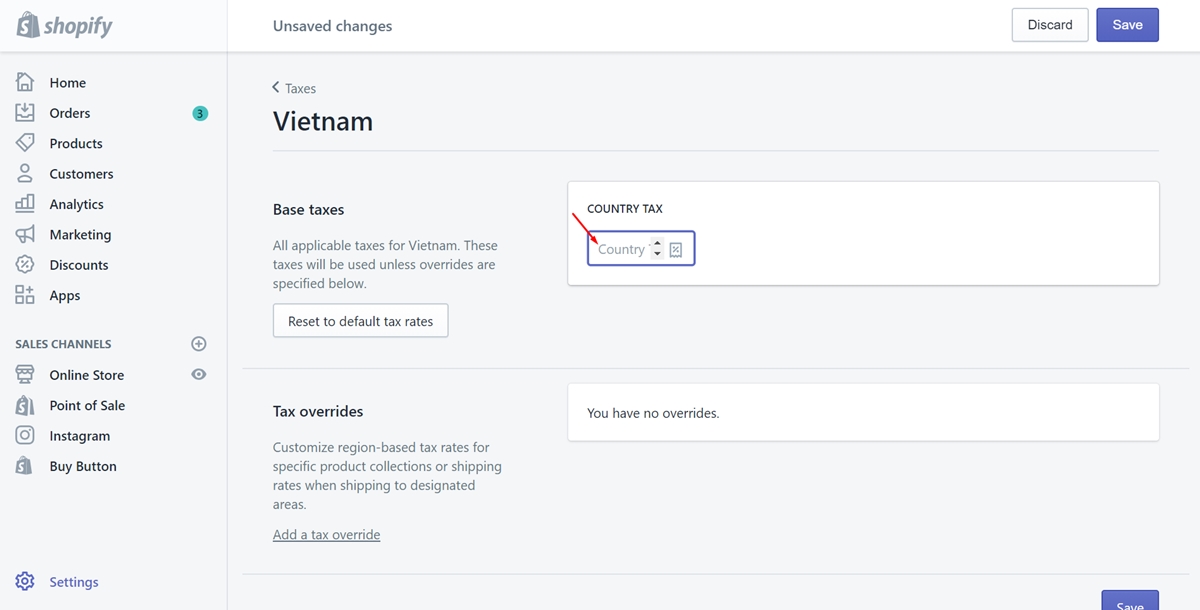

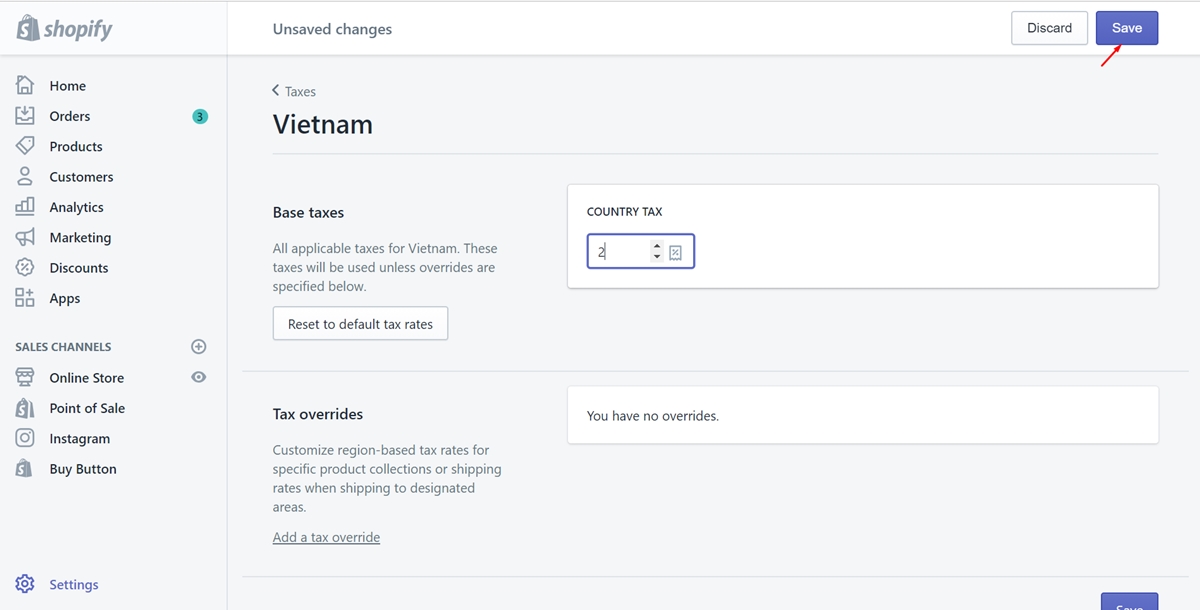

Step 4: Type the rates

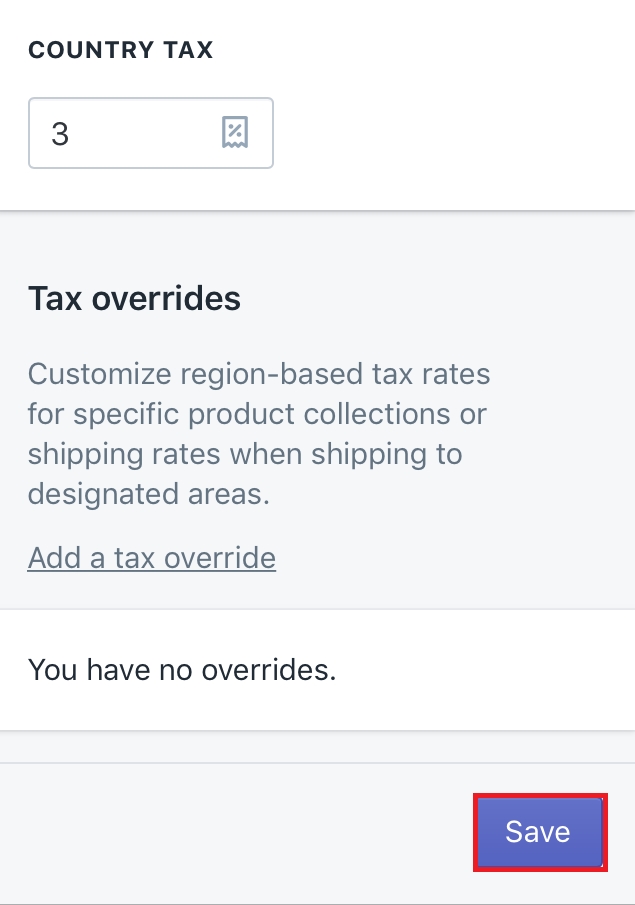

In this step, you need to type the tax rates which is suitable for the country and each region. Moreover, you are able to decide whether the tax is compounded with a federal tax or not.

Step 5: Save

Finally, tap on Save to save all the works you’ve done. The tax rates will take effect right after you press that button.

To set up tax rates in countries other than the United States on iPhone (Click here)

- Step 1: Your store must be outside the United States

You need to log in your Shopify account to access the admin page. Go to theSettingssection on the left-hand side of the page. Then, chooseGeneral. Scroll down to find which place your store is in. If it isn’t the United States, continue to the next step.

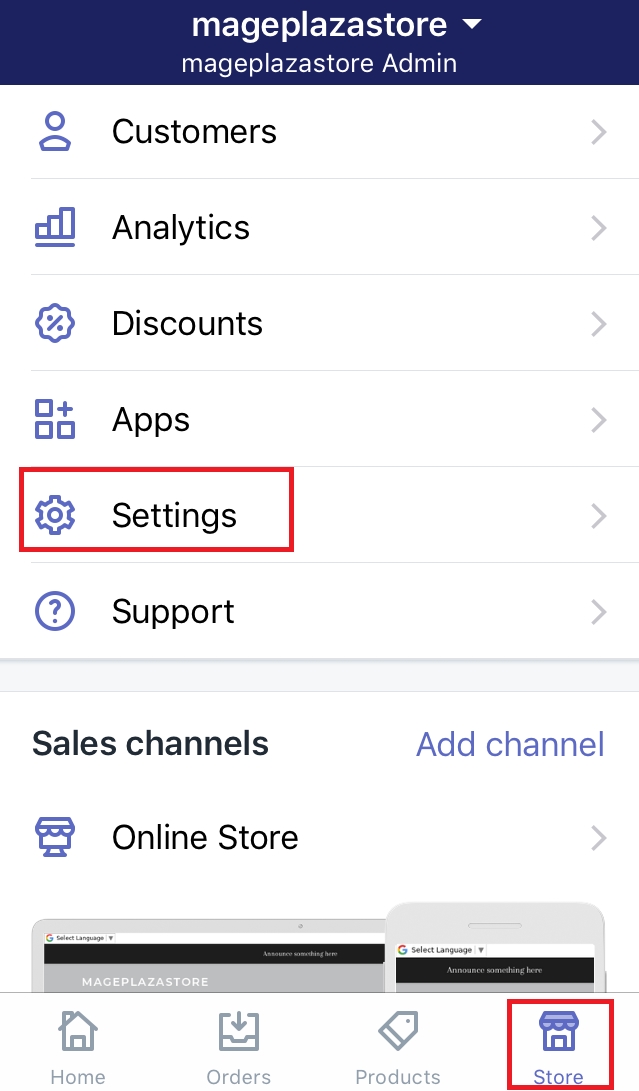

- Step 2: Choose Store and Settings

Back to the admin page and choose theStorebutton at the bottom. Go toSettings.

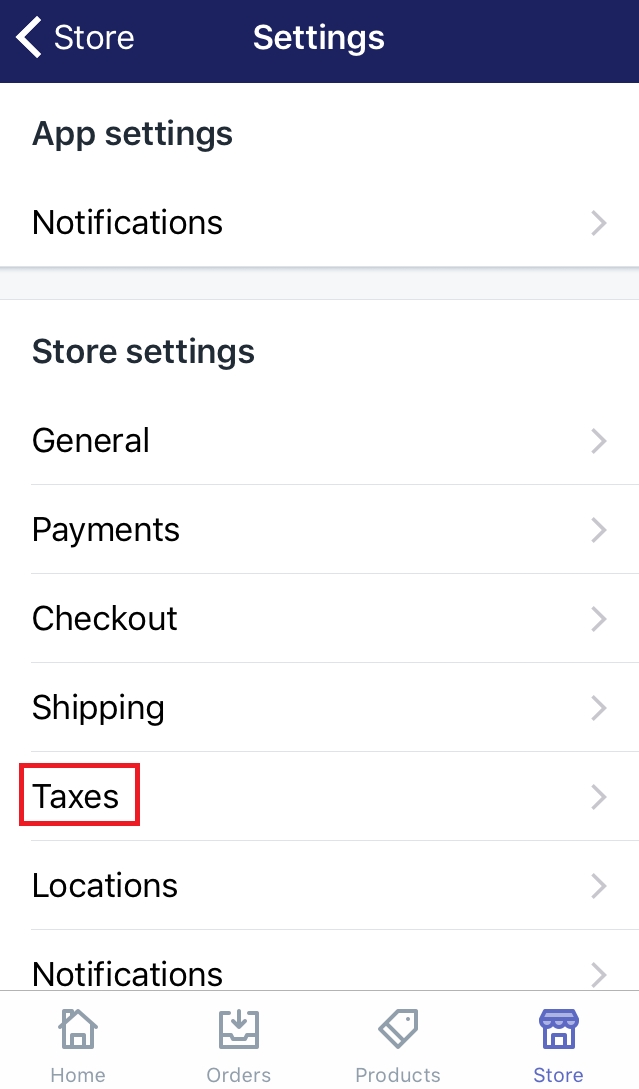

- Step 3: Go to Taxes

To do affair involved in tax such as setting up the tax rate, you need to go to theTaxesfield.

- Step 4: Tap on the country

You must have known which country to choose after the first step. To do this, you just need to press on its name.

- Step 5: Type the rates

In this step, you need to type the tax rates which is suitable for the country and each region. Moreover, you are able to decide whether the tax is compounded with a federal tax or not.

- Step 6: Save

Finally, tap onSaveto save all the works you’ve done. The tax rates will take effect right after you press that button.

To set up tax rates in countries other than the United States on Android (Click here)

-

Step 1: Your store must be outside the United States

You need to log in your Shopify account to access the admin page. Go to theSettingssection on the left-hand side of the page. Then, chooseGeneral. Scroll down to find which place your store is in. If it isn’t the United States, continue to the next step. -

Step 2: Choose Store and Settings

Back to the admin page and choose theStorebutton at the bottom. Go toSettings. -

Step 3: Go to Taxes

To do affair involved in tax such as setting up the tax rate, you need to go to theTaxesfield. -

Step 4: Tap on the country

You must have known which country to choose after the first step. To do this, you just need to press on its name. -

Step 5: Type the rates

In this step, you need to type the tax rates which is suitable for the country and each region. Moreover, you are able to decide whether the tax is compounded with a federal tax or not. -

Step 6: Save

Finally, tap onSaveto save all the works you’ve done. The tax rates will take effect right after you press that button.

Summary

This writing gives you a transparent guide with some simple steps and the illustrated images to set up tax rates in countries other than the United States in the most convenient way. Hope you find it helpful, and if you want more, check out our Shopify tutorials.